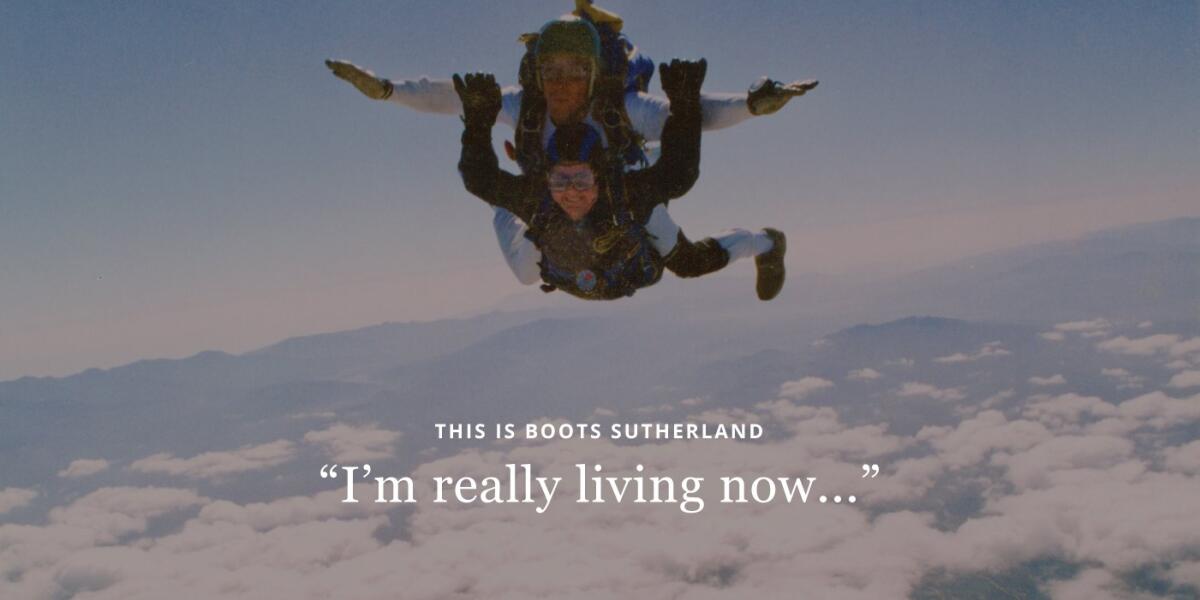

Skydiving at Age 75

It may not be your retirement dream to jump out of an airplane. But, what do you want? What would make your retirement years good? Your desires and dreams are personal and unique to you. Shouldn’t your financial plan be the same?

So, who is this woman jumping out of a plane on her 75th birthday? This is Bernice Sutherland – affectionately known as “Boots.” Thanks in part to her husband Al, who saved and invested very well, they lived her retirement years to the fullest. Boots celebrated life with her family, traveled the world, served as a medical missionary, and drove convertibles. They lived and left a legacy of love - true models of the retirement life!

Meet her youngest son, Ken, and grandson, Alex - your advisors at LifePlan.